Futa tax calculator

To help you estimate the possible effect of this dramatic increase in FUTA taxes on your business - and your ability to manage for example payroll and cash flow -. Calculate 6 of the first 7000 of each employees annual income.

Payroll Tax What It Is How To Calculate It Bench Accounting

Free FUTA Tax Calculator.

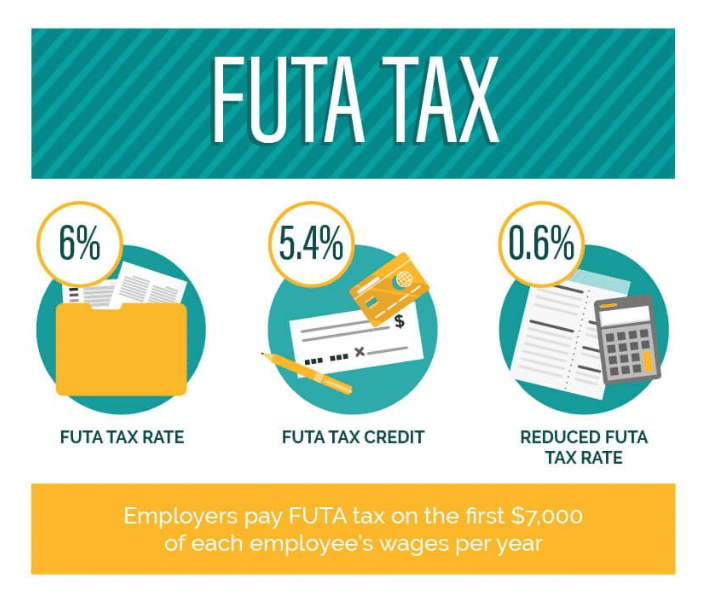

. FUTA Tax per employee Taxable Wage Base Limit x FUTA Tax Rate. If your FUTA tax liability for the next quarter is 500 or less youre not required to deposit your tax again until the cumulative amount is more than 500. The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider additional tax payments or submit a new Form W-4 to their.

With the Taxable Wage Base Limit at 7000 Who pays FUTA. Multiply this total by the standard rate of 0006 18500 x 0006. How to Calculate the FUTA Tax.

A reduction in the usual credit against the full FUTA tax rate means that employers paying wages subject to unemployment insurance UI tax in those states will owe a. You must pay federal unemployment tax based on employee wages or salaries. In the example above this would result in a total taxable amount of 18500 103000-84500 18500.

When a state borrows UI funds from the Federal Unemployment Account FUA and does not repay it within two years that state is designated. The FUTA tax is 6 0060 on the first 7000 of income for each employee. If your total FUTA tax.

Heres a breakdown of how to calculate your quarterly FUTA liability in this scenario. A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised of a 62 tax. Employers and employees should multiply their monthly.

If you have one or more employees who made less than 7000 then youll calculate 6 of their total. However you can also claim a tax credit of up to 54 a max of 378. How to calculate FUTA Tax.

How to Calculate the FUTA Tax. A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised of a 62 tax. Calculate Your Estimated 2016 FUTA Tax.

To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees. Taxes on Medicare however do not have a wage limit. Calculating FICA Medicare Tax.

The standard FUTA tax rate is 6 so your max contribution per employee could be 420. The tax rates are updated periodically and might increase for businesses in certain industries that have. Heres how an employer in Texas would calculate SUTA.

It is subject to compensation for this tax. Each state has its own SUTA tax rates and taxable wage base limit. Add up the wages paid during the reporting period to your employees who are.

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Payroll Tax Calculator For Employers Gusto

What Is Futa Tax It Business Mind

What Is Futa Tax 2021 Tax Rates And Information

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Calculating Employer Payroll Taxes Youtube

Formulate If Statement To Calculate Futa Wages Microsoft Community

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

The Top How To Calculate Federal Unemployment Tax

How To Calculate Unemployment Tax Futa Dummies

Calculating Employer Payroll Taxes Youtube

Futa Tax Overview How It Works How To Calculate

Calculating Futa And Suta Youtube

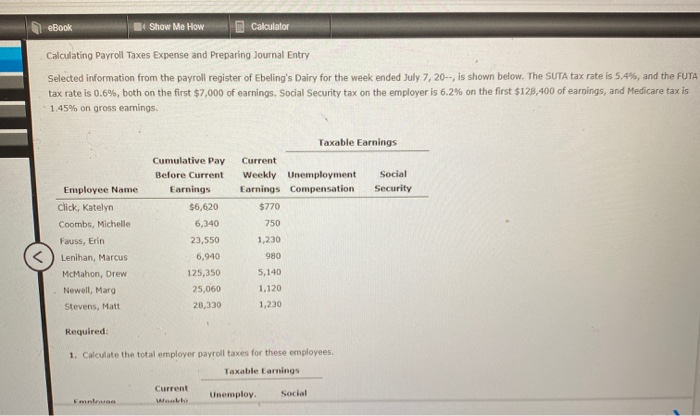

Solved Ebook Show Me How Calculator Calculating Payroll Chegg Com

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

What Is The Federal Unemployment Tax Rate In 2020